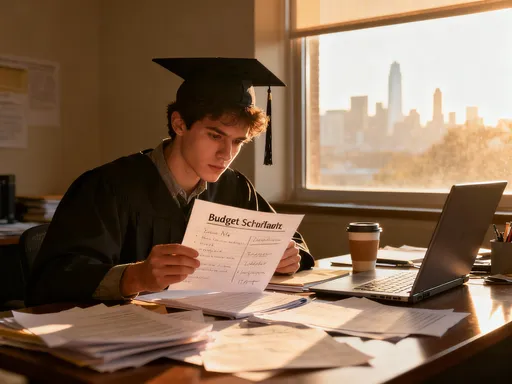

How I Slashed My Grad School Costs Without Sacrificing Quality

By Michael Brown / Nov 29, 2025

Buy Now, Grow Later: My Real Talk on Smarter Spending That Builds Wealth

By Emma Thompson / Nov 29, 2025

How I Secured My Family’s Wealth Without Triggering a Tax Nightmare

By Noah Bell / Nov 29, 2025

How I Stopped Chasing Returns and Started Building Real Wealth

By Emma Thompson / Nov 29, 2025

Smart Parents, Smarter Spending: Raising Kids Without Breaking the Bank

By Joshua Howard / Nov 29, 2025

Smart Money Moves: How I Treat Supplements Like a Financial Asset

By George Bailey / Nov 29, 2025

Buy Now, Pay Smarter: How to Navigate Split Payments Like a Pro

By Samuel Cooper / Nov 29, 2025

Wander Safe, Invest Smart: The Hidden Truth Behind Travel Insurance Markets

By Jessica Lee / Nov 29, 2025

Tax Hacks That Actually Work: My VAT Wins Boosted My Bottom Line

By Eric Ward / Nov 29, 2025

Why I Stopped Ignoring Accident Insurance — A Real Talk on Staying Protected

By Elizabeth Taylor / Nov 29, 2025

Love-Proof Your Money: Smart Investing While Planning Your Wedding

By Emily Johnson / Nov 29, 2025

What I Learned About Risk in Supply Chains—The Hard Way

By Rebecca Stewart / Nov 29, 2025

Why Your Family’s Wealth Could Shrink Without This Tax Move

By Grace Cox / Nov 29, 2025

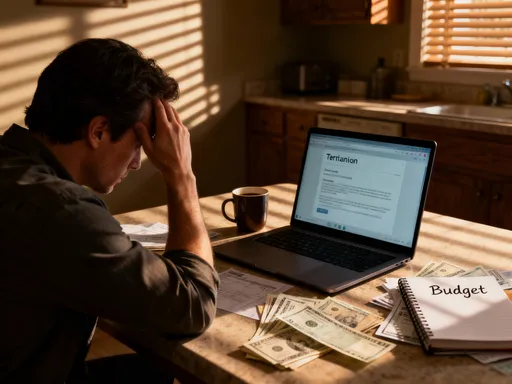

When the Paycheck Stops: How I Navigated Unemployment with Smarter Money Moves

By James Moore / Nov 29, 2025

The Smart Way to Invest in Your Degree Without Breaking the Bank

By Joshua Howard / Nov 29, 2025

Tax Smart, Build Strong: My Wealth Grew When I Started Thinking Like a Strategist

By Emma Thompson / Nov 29, 2025

How I Tamed My Finances: A Real Talk on Smarter Tax Moves

By Natalie Campbell / Nov 29, 2025

Tax Hacks That Changed My Financial Game – And Can Help You Too

By Samuel Cooper / Nov 29, 2025

How I Built Real Passive Income—No Hype, Just What Works

By Noah Bell / Nov 29, 2025